The financial landscape is quickly transforming with the emergence of decentralized finance, or DeFi. This innovative movement leverages blockchain technology to transform traditional financial systems. DeFi offers a wide range of financial services, including lending, borrowing, trading, and even risk management, all without the need for centralized intermediaries.

Proponents claim that DeFi has the potential to empower finance, making it readily available to individuals worldwide. By bypassing bureaucracy, DeFi can facilitate faster, cost-effective transactions and deliver greater transparency and security.

On the other hand, DeFi is still a relatively new technology with its own set of challenges. Security remain key obstacles that need to be addressed for DeFi to achieve mainstream adoption.

Embarking on copyright Trading Strategies for Beginners

copyright trading can seem like a complex endeavor for newcomers. However, by understanding some fundamental strategies, you can confidently dip your toes into this volatile realm. One popular strategy is dollar-cost averaging, which involves investing a fixed amount of copyright at regular intervals. This helps to reduce the risk associated with market fluctuations. Another effective strategy is day trading, where traders aim to profit from short-term price movements within a single day. However, day trading requires in-depth market knowledge and a high tolerance for risk.

Before diving into any strategy, it's crucial to perform thorough research, understand the risks involved, and develop a well-defined trading plan. Remember, patience and discipline are key to success crypto currency in the world of copyright trading.

The Bitcoin Surge: Capturing the Momentum for Profit

As the copyright market surges its volatile journey, Bitcoin has once again embarked on a remarkable bull run. Early Adopters are observing the digital asset's value skyrocket, fueling optimism and creating unprecedented opportunities for those who {dare tojump in. The current bull run is characterized by increasing demand, reduced supply, and a growing recognition of Bitcoin as a legitimate investment asset.

- Nevertheless, it's crucial to tackle this volatile market with prudence.

- Conduct thorough research, implement a sound investment strategy, and continuously track your portfolio.

Steering the Volatile World of copyright

The copyright market is renowned for its sheer volatility, presenting both significant opportunities and heightened risks. Traders and investors must strategically analyze market trends, understand the underlying mechanisms, and implement risk management strategies to thrive in this dynamic landscape.

It's crucial to conduct thorough research before entering any copyright, scrutinizing the project's documentation, team, and support. Diversification across different cryptocurrencies can help reduce portfolio risk. Additionally, staying informed of regulatory developments and market news is essential for making wise decisions.

Remember that copyright investments are extremely speculative, and past performance is not indicative of future results. Always invest only what you can afford to forfeit.

Conquering Technical Analysis in copyright Markets

Diving into the volatile world of cryptocurrencies demands a keen understanding of market dynamics. While fundamental analysis plays a role, mastering technical analysis offers traders with invaluable knowledge to decipher price movements and pinpoint potential trading opportunities. Technical analysis centers on studying historical price data, chart patterns, and indicators to forecast future price action. By utilizing a disciplined approach and persistently honing your skills, you can enhance your chances of success in the fast-paced copyright market.

- Key tools for technical analysis include moving averages, oscillators, and support/resistance levels.

- Price patterns, such as head and shoulders or double tops, can signal potential trend reversals.

- Combining technical analysis with fundamental research can fortify your trading decisions.

Furthermore, staying informed of market news and developments is essential for successful copyright trading. Refine your technical analysis skills through backtesting and simulated trading before executing your strategies in live markets.

A Guide to copyright Security

Navigating the world of copyright requires a steadfast commitment to security. Your digital assets are vulnerable to attacks, and safeguarding them is paramount. This comprehensive guide provides the knowledge you need to encrypt your copyright holdings effectively. Start by choosing a reputable exchange that implements robust security measures. Enable two-factor authentication (copyright) for an extra layer of safety. Regularly update your software and hardware to patch any vulnerabilities. Beware of phishing scams and malware designed to steal your private keys. Educate yourself on best practices for online safety, and always be cautious when sharing sensitive information. By following these guidelines, you can minimize the risk of copyright-related threats and confidently participate in the digital asset landscape.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Kelly Le Brock Then & Now!

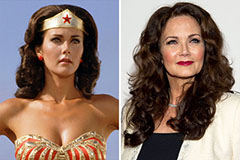

Kelly Le Brock Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!